by Roger | Jun 22, 2025 | Announcements

Moneyweb posted the following on Thursday:

www.moneyweb.co.za/in-depth/investigations/sharemax-rescue-vehicle-o n-the-brink-as-creditors-circle/

In case the article is moved behind Moneywebs paywall, it can also be viewed here www.ndcag.co.za/go/202506191, and for Nova Chair Connie Myburghs response to Moneywebs questions, here <www.ndcag.co.za/go/202506192> www.ndcag.co.za/go/202506192

Whilst, on the surface, it is correct that if Nova goes into liquidation, there is not enough money and insufficient assets, available to meet all of the companys liabilities including the 2.2 billion value of the yet to be repaid debentures, it is not the only source of possible debenture repayment

The article states that the CIPC investigation (into the 2010 shut-down of the PSPC – Property Syndication Promotion Companies – industry which included Sharemax and into Nova itself due to repeated failures to meet Companies Act obligations and the failure to repay all of the debentures by 22 January 2022) has ground to a halt

This is not the case. Yes, we still await the release of the CIPC Investigations Interim Report and have been for almost two years now. But there are actions underway to move forward

On 2 June, CIPC sent out a letter to all of the investigation participants who had already signed and submitted Non-Disclosure Agreements to CIPC (thats non-disclosure of the contents of the Interim Report) together with documentation for recipients comments on the reports contents. The letter opened with a statement to the effect that the recipients had already received the report but not directly from the internal Investigation division of CIPC – probably from their legal area

That report had not been sent out by 2 June and still has not. It appears that, on the one hand, there is much bureaucracy involved which keeps tripping up the release and on the other, we suspect, there are entities, organs of state, and individuals perhaps, who are also intervening because they are going to be seriously embarrassed at what the Final Report reveals whether because of their part in the process that led to the shut-down, or their failure to act when addressed by the activists, some of the PSPC company directors and whoever, on the allegations of wrongdoing

The sending of the letters on 2 June indicates that CIPC Investigation division is ready to proceed and process investigation participants comments as preparation for the CIPC Inquisition (to take place thirty days after the release of the Interim Report) on the findings of the investigation which will lead to the formulation of the Final Report, which, we understand, will be made public

Given the expectation that the findings will expose who and which entities engineered and benefited from the deliberate shut-down (and as has been alleged, capture of the PSPC companies assets) we are of the opinion that all of the PSPC investors (or their successors) can look to the Investigations outcomes as their best hope of receiving their money back

But, it will not necessarily happen quickly. Once the Final Report has revealed the details of the illegalities and irregularities that were perpetrated back in 2010, decisions will have to be made on what to do about the revelations. Once those decisions have been made and implemented, will there be legal action against those persons and bodies found to be responsible and accountable? Will those same persons and bodies institute legal actions of their own to contest the findings and/or to defend their actions? How long will all of that take?

Note also the input from Debenture Trustee J-P Tromp. He is still speaking publicly and in negative terms about Nova which indicates that he is still pursuing actions against the company. We await further news in this regard

Regarding Nova Chair Connie Myburghs response to the liquidation application by Bright Light, wed say that of course he would respond as he did. Typical Myburgh tactics in our opinion. He states that Bright Light is a seemingly unregistered electricity provider. According to CIPC company registrations, Bright Light is registered with CIPC as a Venture Capital Company with enterprise number K201649138. Does that not legitimise them? Anyway, why label them negatively now? Did they not have doubts right from the start of the solar installation project for the relevant properties? If so, why trade with them in the first place (reckless trading)? Or, are those doubts now expressed, just a smokescreen?

Likewise, with Beneficio and the 31 million loan. When they could not repay and the pressure was on, they complained that the interest rate was usury. But they entered into the deal nonetheless! Were the directors wearing blindfolds when they signed the contract? What was the purpose of the loan anyway? Something not benefiting the business per sé and not in the interests of the Debenture Holders?

According to the court record (North Gauteng High Court, Pretoria) for Benefico vs Tarentaal Centre in the Saffli archive – www.saflii.org/za/cases/ZAGPPHC/2023/324.html – Nova stated that [64.4] The money was borrowed as a result of a business decision by the defendants and the NOVA Group to repay debenture holders and to avoid reputational damage it was a business decision which made sense to the defendants and the NOVA Group. It made sense? Whos kidding who here? Was this the true reason? Just another smokescreen? What on Earth would lead the Nova directors to think convince themselves? – that a debenture repayment of 31 million out of a total amount due of 2.2 billion would in any way contribute to avoiding reputational damage? Does that approach mean that they were not aware (and are still not?) of the huge scale of the reputational damage that already applied and continues to apply?

The downside of Novas tactics? They spend company money, what Myburgh publicly referred to, at one of the Debenture Trustee election meetings back in 2021, as our money, implying Debenture Holder money that could be used to repay, to defend their interpretations of the law or the legal opinions received (again, paid for with our money) and to attempt to escape the consequences of what has been alleged as occurrences of reckless trading. Deemed reckless trading which could lead to a CIPC Compliance Notice, in terms of the provisions of the Act, ordering them to cease trading which action in itself will probably lead to further legal action by the company (our money, again)

But the directors will continue promising repayment whilst stalling, fighting and spending our money on legal actions for as long as they can. Why? Because, we believe, Nova is a cash cow which they milk and have been milking ever since they acquired the Sharemax assets. That, we believe, was the hidden purpose behind the Sharemax Business Rescue (refer also Ryk van Niekerks content on the Harrison & White liquidation)

Mr Myburgh and co-directors of Nova Group: we invite you to respond and try to convince us otherwise. But, thats a hell of a mountain to climb and your chances of success are very slim!

by Roger | Jun 22, 2025 | Announcements

Moneyweb het Donderdag die volgende gepubliseer:

www.moneyweb.co.za/in-depth/investigations/sharemax-rescue-vehicle-o n-the-brink-as-creditors-circle/

Ingeval die artikel agter Moneyweb se betaalmuur geskuif word, kan dit ook hier besigtig word: www.ndcag.co.za/go/202506191

En, vir Nova-voorsitter Connie Myburgh se reaksie op Moneyweb se vrae, hier: www.ndcag.co.za/go/202506192

Alhoewel dit oppervlakkig korrek is dat indien Nova tot in likwidasie gaan, daar nie genoeg geld en onvoldoende bates beskikbaar is om al die maatskappy se laste te dek nie insluitend die 2.2 miljard waarde van die nog terugbetaalde skuldbriewe is dit nie die enigste bron van moontlike skuldbriefterugbetaling nie

Die artikel verklaar dat die CIPC-ondersoek (na die 2010-sluiting van die PSPC – Property Syndication Promotion Companies – bedryf, wat Sharemax ingesluit het, en na Nova self weens herhaalde versuim om aan die Maatskappywet-verpligtinge te voldoen en die versuim om al die skuldbriewe teen 22 Januarie 2022 terug te betaal) tot stilstand gekom het

Dit is nie die geval nie. Ja, ons wag steeds vir die vrystelling van die CIPC Ondersoek se Tussentydse Verslag en doen dit nou al vir byna twee jaar. Maar daar is aksies aan die gang om vorentoe te beweeg

Op 2 Junie het CIPC ‘n brief gestuur aan al die ondersoekdeelnemers wat reeds Geheimhoudingsooreenkomste (dit is die nie-openbaarmaking van die inhoud van die Tussentydse Verslag) onderteken en by CIPC ingedien het, tesame met dokumentasie vir die ontvanger se kommentaar oor die inhoud van die verslag. Die brief het begin met ‘n verklaring dat die ontvangers die verslag reeds ontvang het, maar nie direk van die interne Ondersoekafdeling van CIPC nie – waarskynlik van hul regsgebied

Daardie verslag was teen 2 Junie nie uitgestuur nie en is steeds nog nie. Dit blyk dat daar aan die een kant baie burokrasie betrokke is wat die vrystelling aanhoudend belemmer, en aan die ander kant, vermoed ons, is daar entiteite, staatsorgane en miskien individue wat ook ingryp omdat hulle ernstig verleë gaan wees oor wat die Finale Verslag openbaar hetsy as gevolg van hul aandeel in die proses wat tot die sluiting gelei het, of hul versuim om op te tree toe hulle deur die aktiviste, sommige van die PSPC-maatskappydirekteure en wie ook al, oor die bewerings van oortreding aangespreek is

Die versending van die briewe op 2 Junie dui daarop dat die CIPC-ondersoekafdeling gereed is om voort te gaan en die kommentaar van die ondersoekdeelnemers te verwerk as voorbereiding vir die CIPC-ondersoek (wat dertig dae na die vrystelling van die tussentydse verslag sal plaasvind) oor die bevindinge van die ondersoek wat sal lei tot die formulering van die Finale Verslag, wat, soos ons verstaan, openbaar gemaak sal word

Gegewe die verwagting dat die bevindinge sal blootlê wie en watter entiteite die doelbewuste sluiting (en soos beweer is, die kaping van die PSPC-maatskappye se bates) bewerkstellig en daarby baat gevind het, is ons van mening dat al die PSPC-beleggers (of hul opvolgers) na die ondersoek se uitkomste kan kyk as hul beste hoop om hul geld terug te ontvang

Maar dit sal nie noodwendig vinnig gebeur nie. Sodra die finale verslag die besonderhede van die onwettighede en onreëlmatighede wat in 2010 gepleeg is, onthul het, sal besluite geneem moet word oor wat om te doen met die onthullings. Sodra daardie besluite geneem en geïmplementeer is, sal daar regstappe wees teen die persone en liggame wat verantwoordelik en aanspreeklik bevind word? Sal dieselfde persone en liggame hul eie regstappe instel om die bevindinge te betwis en/of hul optrede te verdedig? Hoe lank sal dit alles duur?

Let ook op die insette van die skuldbrieftrustee J-P Tromp. Hy praat steeds in die openbaar en in negatiewe terme oor Nova, wat daarop dui dat hy steeds stappe teen die maatskappy doen. Ons wag vir verdere nuus in hierdie verband

Wat Nova-voorsitter Connie Myburgh se reaksie op die likwidasie-aansoek deur Bright Light betref, sou ons sê dat hy natuurlik sou reageer soos hy gedoen het. Tipiese Myburgh-taktiek na ons mening. Hy sê dat Bright Light “‘n skynbaar ongeregistreerde elektrisiteitsverskaffer” is. Volgens CIPC-maatskappyregistrasies is Bright Light by CIPC geregistreer as ‘n Venture Capital Company met ondernemingsnommer K201649138. Legitimeer dit hulle nie? Hoe dit ook al sy, hoekom hulle nou negatief etiketteer? Het hulle nie van die begin van die sonkraginstallasieprojek vir die betrokke eiendomme twyfel gehad nie? Indien wel, hoekom in die eerste plek met hulle handel dryf (roekelose handel)? Of word daardie twyfel nou uitgespreek, net ‘n rookskerm?

Net so, met Beneficio en die lening van 31 miljoen. Toe hulle nie kon terugbetaal nie en die druk hoog was, het hulle gekla dat die rentekoers woeker was. Maar hulle het nietemin die transaksie aangegaan! Het die direkteure blinddoeke gedra toe hulle die kontrak onderteken het? Wat was in elk geval die doel van die lening? Iets wat nie die besigheid per sé bevoordeel het nie en nie in die belang van die skuldbriefhouers was nie?

Volgens die hofrekord (Noord-Gauteng Hooggeregshof, Pretoria) vir Benefico vs Tarentaal-sentrum in die Saffli-argief – www.saflii.org/za/cases/ZAGPPHC/2023/324.html – het Nova verklaar dat [64.4] The money was borrowed as a result of a business decision by the defendants and the NOVA Group to repay debenture holders and to avoid reputational damage it was a business decision which made sense to the defendants and the NOVA Group. Sin gemaak? Wie kul nou vir wie hier? Was dit die ware rede of ook nog ‘n rookskerm? Wat op aarde sou die Nova-direkteure laat dink hulself oortuig? dat ‘n skuldbriefterugbetaling van 31 miljoen uit ‘n totale verskuldigde bedrag van 2,2 miljard op enige manier sou bydra tot die vermyding van reputasieskade? Beteken daardie benadering dat hulle nie bewus was nie (en steeds nie is nie?) van die enorme omvang van die reputasieskade wat reeds gegeld het en steeds geld?

Die nadeel van Nova se taktiek? Hulle bestee maatskappygeld, waarna Myburgh in 2021 in die openbaar verwys het tydens een van die verkiesingsvergaderings vir die Skuldbrieftrustee, as “ons geld”, wat impliseer dat Skuldbriefhouergeld gebruik kan word om terug te betaal, hul interpretasies van die wet of die ontvangde regsmenings te verdedig (weer eens betaal met “ons” geld) en om te probeer ontsnap aan die gevolge van wat beweer is as gevalle van roekelose handel. Veronderstelde roekelose handel wat kan lei tot ‘n CIPC-nakomingskennisgewing (Compliance Notice), ingevolge die bepalings van die Wet, wat hulle beveel om op te hou handel dryf, welke aksie op sigself waarskynlik tot verdere regstappe deur die maatskappy (“ons” geld, weer eens) sal lei

Maar die direkteure sal voortgaan om terugbetaling te belowe terwyl hulle so lank as moontlik “ons geld” aan regstappe, uitstel (stalling), opponerendeveg (opposing) bestee. Hoekom? Omdat, glo ons, Nova ‘n kontantkoei (cash cow) is wat hulle melk en gemelk het sedert hulle die Sharemax-bates verkry het. Dit, glo ons, was die versteekte doel agter die Sharemax Besigheidsredding van die begin af (verwys na Ryk van Niekerek se skrywe oor die Harrison & White likwidasie)

Mnr. Myburgh en mededirekteure van Nova Groep: ons nooi u uit om te reageer en ons te probeer oortuig om anders te dink. Maar dis ‘n helse berg om te klim en u kanse op sukses is baie skraal!

by Kobus | Apr 10, 2025 | Announcements

Ons wag steeds vir die vrystelling deur CIPC van hul Tussentydse Verslag oor hul ondersoek na die sluiting van die eiendomsindikasiemaatskappye (insluitend Sharemax) in 2010 en ook na Nova Property

Ons deel onlangse korrespondensie tussen Deon Pienaar – lank en ‘n leidende, aktivis teen die beweerde onwettighede en onreëlmatighede deur entiteite en persone terug in 2010 – en Cuma Zwane, Senior Ondersoeker by CIPC, oor die status van die ondersoek

Die meegaande dokumente is slegs in Engels beskikbaar

Sien onder vir beelde van twee relevante e-posse

Die gedetailleerde terugvoer van CIPC kan hier gelees word:

https://www.ndcag.co.za/go/response-letterdj-pienaar

(Neem kennis dat sekere areas uitgelig is vir die maklike lees van die opvallende inhoud. Daarbenewens is opmerkings op sommige plekke ingevoeg. As dit in Adobe Acrobat oopgemaak is, moet die opmerkingspaneel sigbaar wees. As dit in Chrome – of ander blaaier oopgemaak is? – beweeg jou muis oor die pers hoogtepunte om die opmerking te sien )

by Kobus | Apr 10, 2025 | Announcements

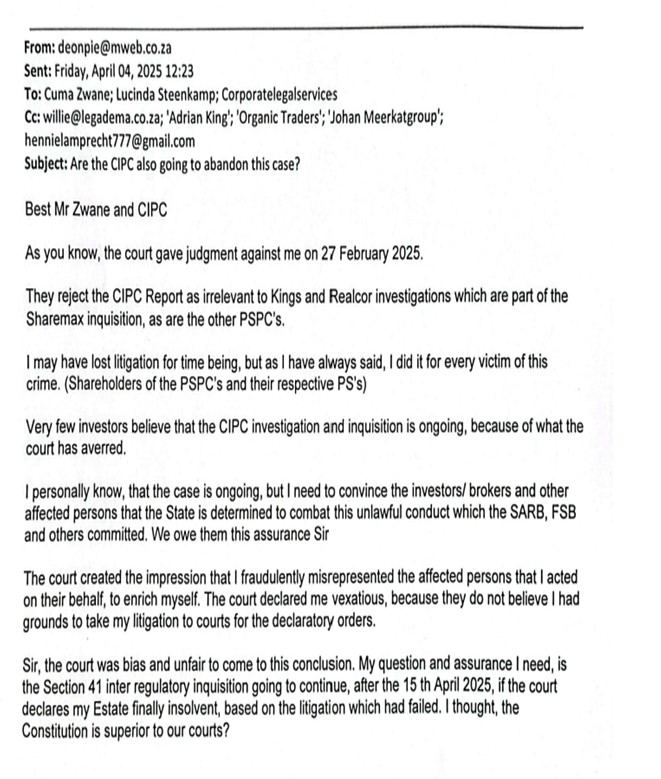

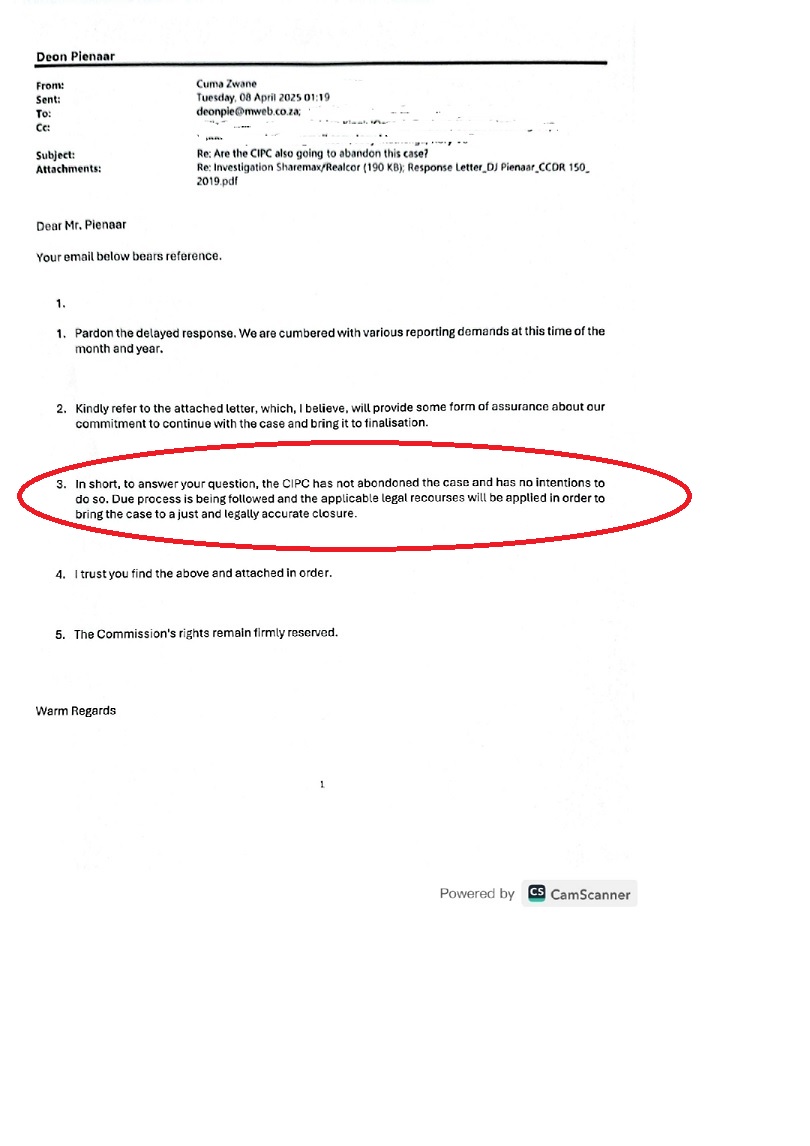

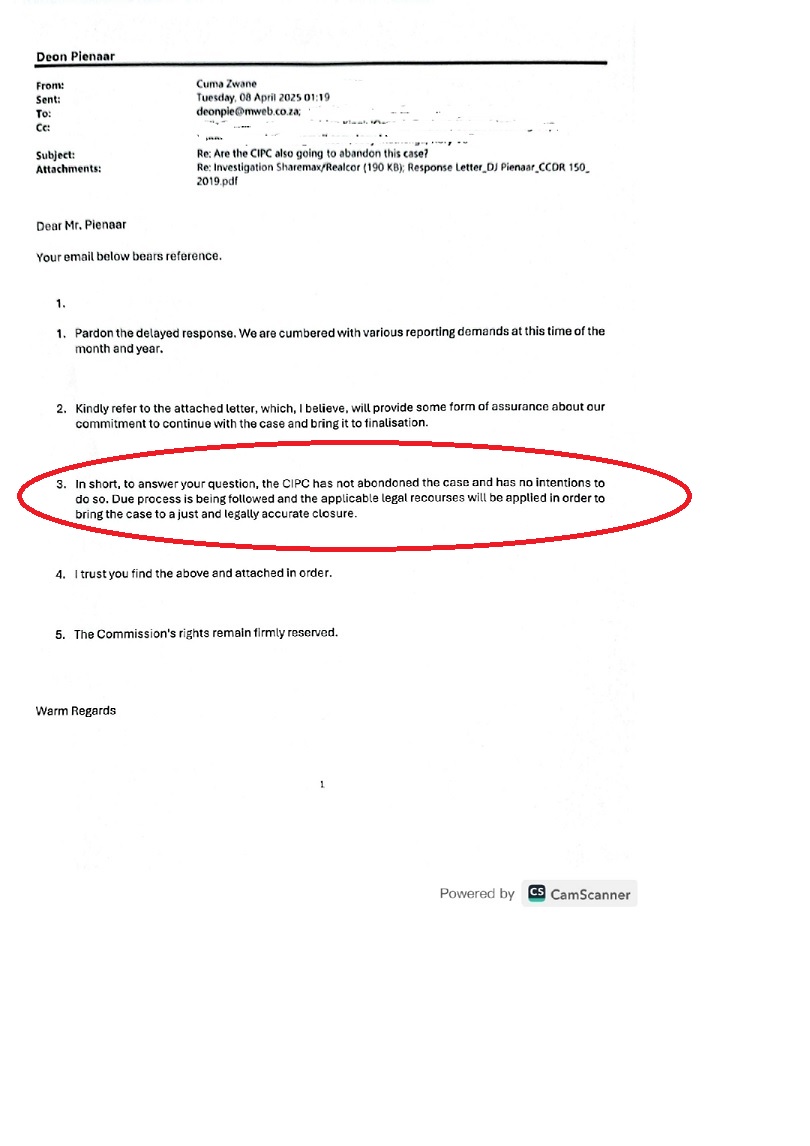

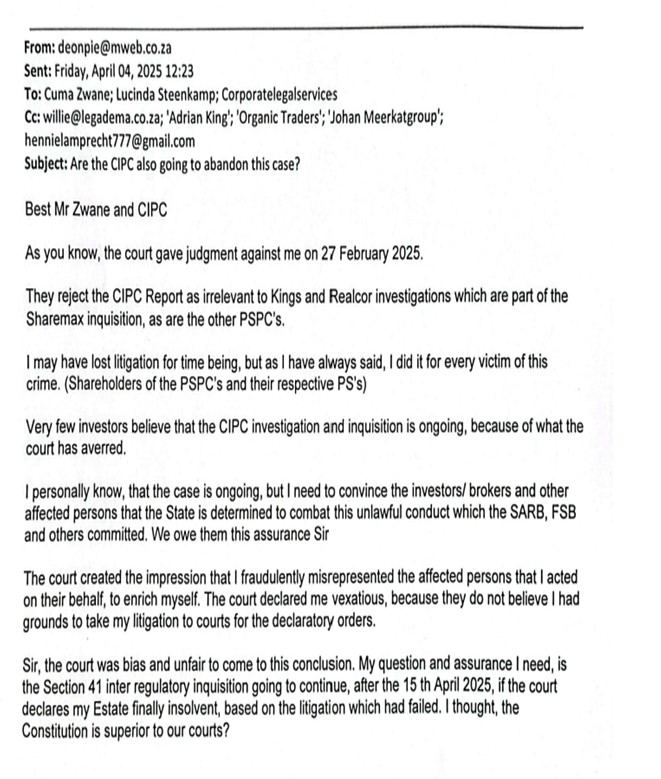

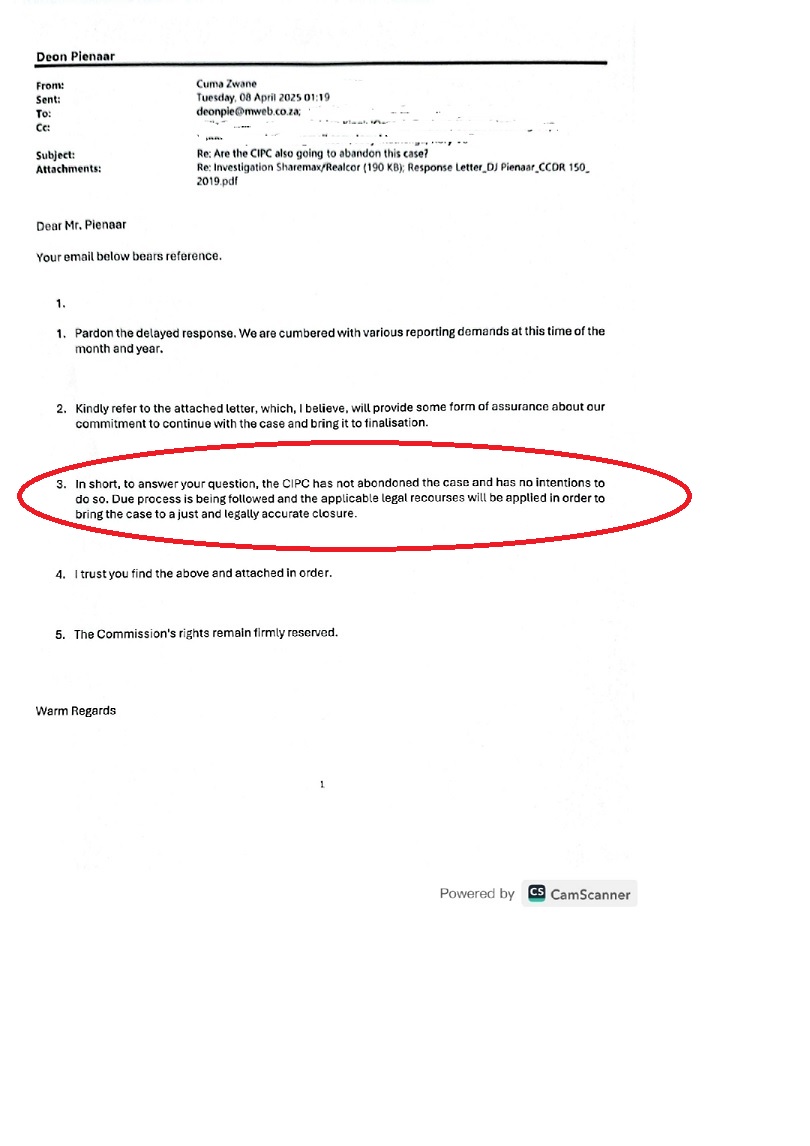

We continue to wait for the release by CIPC of their Interim Report on their investigation into the shut-down of the Property Syndication Companies (including Sharemax) in 2010 and also into Nova Property

We share recent correspondence between Deon Pienaar – long time, and a leading activist against the alleged illegalities and irregularities by entities and persons back in 2010 – and Cuma Zwane, Senior Investigator at CIPC – on the status of the investigation

See below for images of two relevant emails

The detailed feedback from CIPC can be read here:

https://www.ndcag.co.za/go/response-letterdj-pienaar

(Note that, for ease of reading the salient content, certain areas have been highlighted. In addition , comments have been inserted in some places. If opened in Adobe Acrobat, the comments panel should be visible. If opened in Chrome – or other browser? – hover your mouse over the purple highlights to see the comment )

by Roger | Mar 24, 2025 | Announcements

Moneyweb het hul ontleding van die Nova Finansiële Jaarstate soos op 28 Februarie 2024 gemaak

www.moneyweb.co.za/moneyweb…/nova-insolvency-pays/

(Artikel slegs in Engels beskikbaar)

Uittreksel:

“The delay ensured that Nova, a high-profile company tasked by the high court to repay investors of the largest failed property investment scheme, could hide the disclosure of its dire financial position to debenture holders, creditors and other stakeholders for five months.”

Hierdie “wegsteek” was in werklikheid vir ‘n tydperk van dertien maande, wat dateer vanaf die laat publikasie, laat Desember ’23, van die 2023 finansiële state – wat die laaste openbare kommunikasie deur Nova was voor die vrystelling van die ’24 state in Januarie ’25

<www.moneyweb.co.za/moneyweb-opinion/nova-insolvency-pays/?fbclid=Iw ZXh0bgNhZW0CMTEAAR2dZmpn1cEXUiJ6UEoxR4XMcLcEUICOJtysbdsPYAxXIDUHozKmX3ouzYU_ aem_rRuJbGEGw1Vn3eh_VwURpA>

<www.moneyweb.co.za/moneyweb-opinion/nova-insolvency-pays/?fbclid=Iw ZXh0bgNhZW0CMTEAAR2dZmpn1cEXUiJ6UEoxR4XMcLcEUICOJtysbdsPYAxXIDUHozKmX3ouzYU_ aem_rRuJbGEGw1Vn3eh_VwURpA>

Hierdie “wegsteek” was in werklikheid vir ‘n tydperk van dertien maande, wat dateer vanaf die laat publikasie, laat Desember ’23, van die 2023 finansiële state – wat die laaste openbare kommunikasie deur Nova was voor die vrystelling van die ’24 state in Januarie ’25

by Roger | Mar 24, 2025 | Announcements

Moneyweb have produced their analysis of the Nova Annual Financial Statements as at 28 February, 2024

www.moneyweb.co.za/moneyweb…/nova-insolvency-pays/

Extract:

“The delay ensured that Nova, a high-profile company tasked by the high court to repay investors of the largest failed property investment scheme, could hide the disclosure of its dire financial position to debenture holders, creditors and other stakeholders for five months.”

This “hiding” was in fact for a period of thirteen months, dating from the late publication, in late December ’23, of the 2023 financial statements – which was the last public communication by Nova prior to the release of the ’24 statements in January ’25

This “hiding” was in fact for a period of thirteen months, dating from the late publication, in late December ’23, of the 2023 financial statements – which was the last public communication by Nova prior to the release of the ’24 statements in January ’25

by Roger | Feb 27, 2025 | Announcements

The CIPC have turned to the private sector to find Senior Counsel to head up the further stages of the investigation

We have learnt that appointments have been made and that they will be briefed by CIPC officials on 6 March “to unpack the preliminary report and scope the inquisition’s objectives and expected outputs (a final report with recommendations)”

This will trigger the release of the Investigation’s Interim Report. It will be emailed to those of the investigation participants who have returned signed non-disclosure agreements. CIPC then allows a thirty-day period “to allow affected parties to gather supplementary and supporting evidence and explore any other available legal remedy, while awaiting the contemplated inquisition.” Affected parties are the investigation participants

Then the investigation’s preliminary outcomes will be addressed at two levels:

* An “inquisition” will cover the “origin of the Schemes of Arrangement” (SoA) which means, in effect, how the Sharemax Business Rescue Plan originated and how it was sanctioned by the Courts under the provisions of Section 311 of the Companies Act * A separate internal tribunal within the Dtic (Department of Trade , Industry and Competition – of which CIPC is a Division) to address “the execution by Nova” meaning the execution of the SoA mission which is restitution for the original Sharemax investors or their successors and the reason for Nova’s existence

Thereafter, the Final Report will be released and the matter will enter a new phase where “a higher authority must be approached for a declaratory order.” But, “This obviously cannot happen before we give vent to Section 41 of the Constitution to allow those who may have been wrong in endorsing the Schemes to regularise a “crime”( which, in terms of the preliminary report; is found to be amiss and unlawful) a chance to defend their historical actions or concede that they were factually wrong.”

In other words, the findings which will hopefully turn the historical allegations of illegality and irregularity about the PSPC industry shut-down, into “fact” and presumably, persons and entities – both in the private and public sectors – will be named and thus, effectively, accused of “a crime” or wrongdoing. It is those persons and entities who/that will be given the chance to “defend their historical actions or concede that they were factually wrong”

What will follow is that quite possibly there could be legal actions which, in their turn, will take time. And then, there may also be a, possibly extended, period of negotiations on how to achieve restitution for the Sharemax investors

So, whilst the investigation is moving forward to its conclusion and whilst there is a good chance that the initial outcomes will beneficial for the Sharemax investors, these will also be the start of a lot of other legal processes which in their turn, will probably also take time

by Roger | Feb 27, 2025 | Announcements

Die CIPC het hom tot die private sektor gewend om Senior Advokate te vind om die verdere fases van die ondersoek te lei

Ons het verneem dat aanstellings gemaak is en dat hulle op 6 Maart deur CIPC-amptenare ingelig sal word“to unpack the preliminary report and scope the inquisition’s objectives and expected outputs (a final report with recommendations)”.

Dit sal die vrystelling van die Ondersoek se Tussentydse Verslag veroorsaak en wat sal per e-pos gestuur word aan diegene van die ondersoekdeelnemers wat ondertekende Non-disclosure Agreements teruggestuur het. CIPC laat dan ‘n tydperk van dertig dae toe “to allow affected parties to gather supplementary and supporting evidence and explore any other available legal remedy, while awaiting the contemplated inquisition.” Geaffekteerde partye is die ondersoekdeelnemers

Dan sal die ondersoek se voorlopige uitkomste op twee vlakke aangespreek word:

– Die “inkwisisie” sal die “origin of the Schemes of Arrangement” (SoA) dek, wat beteken: hoe die Sharemax Besigheidsreddingsplan ontstaan het en hoe dit deur die Howe goedgekeur is kragtens die bepalings van Artikel 311 van die Maatskappywet

– ‘n afsonderlike interne tribunaal binne die Dtic (Department of Trade, Industry and Competition) waarvan CIPC ‘n afdeling is, om “the execution by Nova” aan te spreek, wat beteken die uitvoering van die SoA-missie deur Nova waarvan die terugbetaling aan die oorspronklike Sharemax-beleggers of hul opvolgers hul bestaansrede is

Daarna sal die finale verslag vrygestel word en die aangeleentheid sal ‘n nuwe fase betree waar “a higher authority must be approached for a declaratory order.”Maar, “This obviously cannot happen before we give vent to Section 41 of the Constitution to allow those who may have been wrong in endorsing the Schemes to regularise a “crime”( which, in terms of the preliminary report; is found to be amiss and unlawful) a chance to defend their historical actions or concede that they were factually wrong.”

Met ander woorde, die bevindings wat hopelik die historiese bewerings van onwettigheid en onreëlmatigheid oor die sluiting van die PSPC-industrie sal verander tot in “feitlik” en vermoedelik sal persone en entiteite – beide in die private en openbare sektore – genoem word en dus, effektief, van “‘n misdaad” of oortreding beskuldig word. Dit is daardie persone en entiteite aan wie/wat die kans gegee sal word om te “defend their historical actions or concede that they were factually wrong”

Wat sal volg, is dat daar heel moontlik regsaksies kan volg wat op hul beurt tyd sal neem. En dan kan daar ook ‘n, moontlik verlengde, tydperk van onderhandelinge wees oor hoe om restitusie vir die Sharemax-beleggers te bewerkstellig

Dus, terwyl die ondersoek vorder na sy afsluiting en terwyl daar ‘n goeie kans is dat die aanvanklike uitkomste voordelig sal wees vir die Sharemax-beleggers, sal dit ook die begin wees van baie ander regsprosesse wat in hul sin ook tyd sal neem

by Kobus | Feb 25, 2025 | Announcements

Die 2024 Jaarlikse Finansiële State (JFS) is uiteindelik – amper ‘n jaar na die jaareinde van 28 Februarie 2024 – vrygestel en op die Nova-webwerf gepubliseer. Sien: [https://novapropertygroup.co.za/> Downloads > Financial Statements](https://novapropertygroup.co.za/> Downloads > Financial Statements).

Hoekom het dit so lank geneem? En hoekom is dit altyd laat? Hoekom sukkel Nova blykbaar altyd om ouditbevestiging te kry? Gee Nova enigsins om, of is die uitvoerende bestuur se enigste fokus om die maatskappy tot in die grond te bestuur terwyl hulle, klaarblyklik, soveel moontlik waarde vir hulself probeer onttrek?

Ons verstaan dat Moneyweb binnekort hul gebruiklike oorsig van die JFS sal publiseer, en ons sal hier en op die webwerf inlig wanneer dit beskikbaar is.

Is dit beduidend dat geen Kommunikasie gelyktydig met die 2024 JFS gepubliseer is nie (in teenstelling met die jare 2021, 2022 en 2023 waarvoor een gepubliseer is)? Hoekom geen Kommunikasie vir 2024 nie? Die Kommunikasies verskaf (of behoort te verskaf) ‘n sekere vlak van inligting oor die individuele eiendomme wat aanvullend tot die inhoud van die JFS is. In die Desember 2023 Kommunikasie het die maatskappy sulke aanvullende inligting oor die nege kommersiële eiendomme in die portefeulje verskaf, maar net oor een (Theresa Park) van die residensiële ontwikkelings.

Ons plaas die volgende om kwessies aan die lig te bring wat Nova in die donker hou, wat beteken dat die Skuldbriefhouers – die maatskappy se grootste krediteure – geen idee het van die werklike situasie binne die maatskappy nie.

Ons het laat verlede jaar ‘n video ontvang wat die leegheid van die Tshwane China Inkopiesentrum (voorheen Zambezi Mall) toon. Sien skakels hieronder na Businesstech se plasing oor die eiendom.

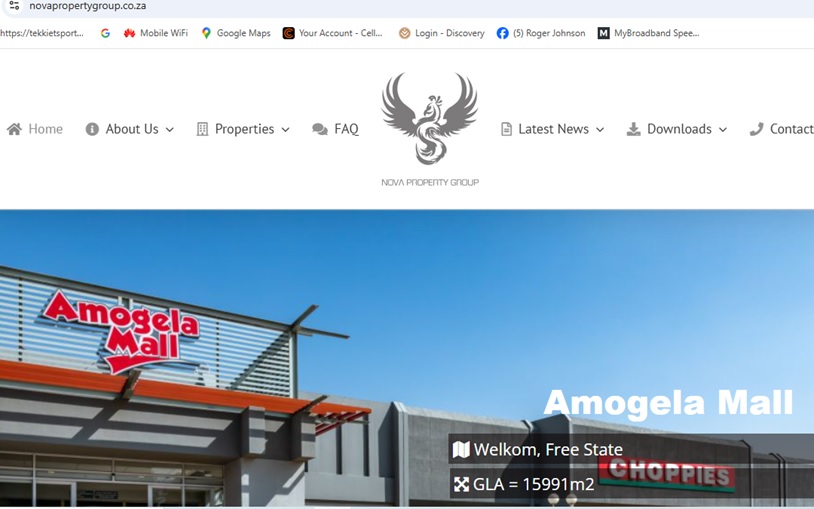

Net so het ons ‘n videoklippie ontvang oor die toestand van die voormalige Liberty Centre in Welkom – nou herdoop tot Amogela Mall. Sien skakels hieronder na videoklippies en ‘n mediaplasing.

Ons is ook al lank bewus van die onwettige besetting van die Waterfall Residensiële Landgoed in Rustenburg deur informele inwoners. Sien gepaardgaande foto’s.

Hierdie situasies laat dadelik ‘n vraag ontstaan oor Nova se prestasie en vooruitsigte.

‘n Tweede vraag is: Hoekom gebeur hierdie situasies en wat word gedoen om dit reg te stel – vanuit die oogpunt dat die maatskappy ten volle in beheer van sy sake en bates is en vorentoe kan beweeg na terugbetaling van die uitstaande skuldbriewe (nie dat ons enige vertroue het dat die uitvoerende bestuur dit regtig sal regkry nie)?

En, ‘n derde vraag: Hoeveel ander eiendomme is ook “in nood” – in een of ander vorm – uit die oorblywende nege kommersiële en sewe residensiële ontwikkelings wat nog op die boeke is?

Ons weet nie, want Nova bly kampioene in nie-kommunikasie. Die laaste Kommunikasie wat uitgereik is, was in Desember 2023 as ‘n begeleiding tot die 2023 JFS. Die Kommunikasies was oorspronklik bedoel om kwartaalliks uitgereik te word en behoort die Skuldbriefhouers in te lig oor die status, prestasie en ander relevante inligting oor die portefeulje se eiendomme (wel, dié wat oorbly nadat baie oor tyd verkoop is sonder gepaste skuldbriefterugbetaling). Verlede jaar se Kommunikasie het ver tekort geskiet in die verskaffing van ‘n voldoende prentjie van die oorblywende eiendomme, en daar was nog geen in 2024 nie.

Kort besonderhede oor die drie eiendomme:

Liberty/Amogela in Welkom

Hierdie eiendom is in 2021 verkoop. Dit verskyn nie in die 2022 JFS nie, en in die gepaardgaande Kommunikasie is aangedui dat “die eiendom is verkoop en die oordrag is op 13 Desember 2021 geregistreer”. Die verkoopprys is nie bekend gemaak nie. Nodeloos om te sê (maar ons sê dit in elk geval), die relevante skuldbriewe is nie terugbetaal nie (boekwaarde in die 2023 JFS was R21.6 miljoen).

Daar word beweer dat die koper nooit vir die eiendom betaal het nie, maar, gegewe Nova se rekord sedert 2013, sal lesers waarskynlik sinies lag oor ons voorstel dat die Liberty/Amogela-verwante skuldbriewe dalk sou terugbetaal gewees het as die verkoopproses werklik plaasgevind het.

Om alles te kroon, is die skuldbriefwaarde van Amogela in die 2024 JFS net R5.6 miljoen – ‘n afname van R16 miljoen van die 2023-figuur. Wat beteken dit? Het Nova ‘n deel van die Amogela-skuldbriewe terugbetaal sonder om dit aan te kondig? Ons glo nie, en moet dus vra: Waarom die skuldbriefskrywing afwaarts, en wat is die impak op die relevante Skuldbriefhouers?

Liberty/Amogela Mall Skakels:

Facebook Video

Facebook Watch

Nuus24 Artikel

Zambezi/Tshwane China Inkopiesentrum

Het hierdie eiendom ooit sonder probleme bestaan? Daar was geskil met Capicol (die ontwikkelaar), oorstromings, lae okkupasiesyfers en betalingsprobleme met die Tshwane Metropolitaanse Munisipaliteit. Nou is daar amper nul besetting en geen inkomstestroom nie, maar daar moet steeds betalings vir dienste gemaak word – tensy Nova weer wanbetaling doen, soos in 2023 met 12 eiendomme wat deur die Quatro Group bedien is.

Zambezi/Tshwane China Mall Skakels:

YouTube Video

BusinessTech Artikel

Waterfall Residensiële Landgoed

Ons het lankal geweet van die onwettige besetting, en is ingelig dat Nova in gesprekke was (of is) met die Rustenburg Plaaslike Munisipaliteit oor die kwessie. Maar natuurlik het Nova niks hieroor bekend gemaak nie. Gaan Nova ooit die eiendom kan herwin, of is dit nou ‘n verlore saak?

Debentures in die 2023 JFS:

- Liberty/Amogela: R21.6 miljoen (maar R5.6 miljoen in 2024 JFS)

- Zambezi: R503.4 miljoen

- Waterfall: R47.2 miljoen

Ons twyfel steeds of die uitvoerende bestuur enigsins die vermoë het om hierdie skuldbriewe terug te betaal.

As enige van bogenoemde verkeerd is, verwelkom ons ‘n verduideliking van die Nova-direksie – maar meer belangrik, ‘n volledige antwoord oor die gapings wat hierbo uiteengesit is. Dit sou ten minste ‘n werklike kommunikasie wees – ‘n seldsame gebeurtenis in die afgelope paar jaar.

by Kobus | Feb 25, 2025 | Announcements

The 2024 Annual Financial Statements (AFS) have – at last, and almost a year after the year-end of 28 February ’24 – been released and published in the Nova web site. See https://novapropertygroup.co.za/> Downloads > Financial Statements

Why has it taken so long? And why are they always late? Why does Nova always seem to struggle to get auditor sign-off? Does Nova even care or, is the Executive’s only focus that of running the company into the ground while they, apparently, extract as much value for themselves as they can?

We understand that Moneyweb will be publishing their usual review of the AFS soon and we will inform here and in the web site when it is available

Is it significant that a Communiqué has not been published simultaneously to the ’24 AFS (as opposed to the years 20121/2/3 for which one was published). Why no Communiqué for ’24? The Communiqués provide (or presumably, do) a level of information on the individual properties that is supplemental to the AFS content. In the December ’23 Communique, the company provided such supplemental information on the nine commercial properties in the portfolio but only on one (Theresa Park) of the residential developments

We post the following to raise some issues which Nova have been keeping in the dark meaning that the Debenture Holders – major creditors of the company – have no idea of the real situation within the company

- We received a video on late last year showing the empty state of the Tshwane China Shopping Mall, formerly Zambezi Mall. See links below to Businesstech’s posting on the property

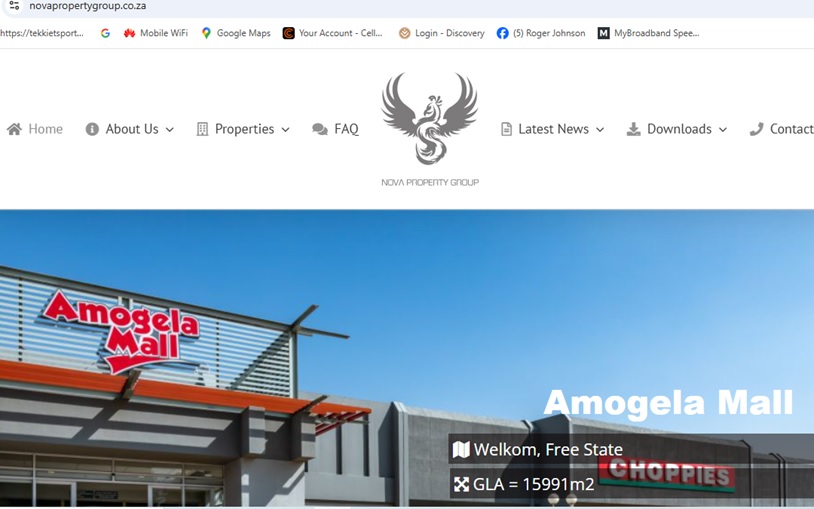

- Likewise, we also received a video clip on the state of the former Liberty Centre in Welkom – was renamed Amogela Mall. See below links to video clips and a media post

- We’ve also long been aware of the illegal occupation of the Waterfall Residential Estate property in Rustenburg by informal settlers. See accompanying pictures

These situations immediately raise a question about Nova regarding its performance and its prospects

A second question is: Why these situations and what is being done to remedy them – obviously from the point of view of the company being fully in control of its affairs and assets and able to move forward towards repayment of the outstanding debentures (not that we have any confidence in the executive actually achieving this)?

And, a third question: How many other properties are also “in distress” – in one form or another – out of the remaining nine commercial and seven residential development properties that remain on the books?

We don’t know because Nova remain champions at non-communication. The last Communiqué issued was in December 2023 as an accompaniment to the ‘23 AFS. The Communiqués were originally intended to be issued quarterly and are supposed to keep the Debenture Holders informed of the status, performance and other information relevant to the portfolio properties (well, those that are now left in the portfolio anyway after many were sold off over time without relevant debenture repayment). Last year’s Communique fell far short of providing an adequate picture on the remaining properties and there haven’t been any during 2024 and so far this year

Some brief details about the three properties:

Liberty/Amogela in Welkom

This property was sold during 2021. It does not feature in the 2022 AFS and in the accompanying Communiqué it is stated that “the property has been sold and transfer was registered on 13 December 2021”. The selling price was not disclosed. Needless to say (but we’ll say it anyway), the relevant debentures were not repaid (book liability in ’23 AFS was 21.6 million). Perhaps that was impossible because, according to rumour, the buyer has never paid for the property (but, given Nova’s track record since 2013, readers may well laugh cynically at our suggesting that the Liberty/Amogela related debentures might have been repaid had the sale proceeds actually been received). AFS ’21 book value for the property was 21.3 million

In all other property sales since 2012 the sale proceeds were retained and applied to working capital to keep the company afloat (until August 2022 when CIPC issued a Compliance Notice prohibiting the sale of further of the properties). This was an arbitrary and unilateral decision by the board without informing, consulting or at the very least, a presentation of some sort communicated in which they would have motivated their actions. And they expect us to trust them!

And, to cap it all, the liability value of the Amogela related debentures listed in the ’24 AFS is only 5.6 million, a decrease of 16 million from the 2023 figure. What does this mean? Have Nova repaid some of the Amogela debentures? They’d do that without trumpeting that they had done so? We don’t think that they have and thus, must question: Why the liability value write-down and what is the potential impact on the relevant Debenture Holders?

And, if Amogela Mall is both derelict and unlisted in the financial statements, why does it still appear in the scrolling images of the portfolio of commercial properties in the home page and advertising a Gross Letting Area of 15 991 square metres? Misleading if not misrepresentation, surely?

Liberty/Amogela

Zambezi/Tshwane China Shopping Mall

Has this property ever been without problems? – issues between Nova and the developer, Capicol, flooding, low occupancy rates and services payments issues with Tshwane Metropolitan Municipality. Now, all but zero occupancy meaning no income stream but with payments for services still required (unless Nova are defaulting again – as happened with twelve properties contractually serviced by the Quatro Group which led to an application for liquidation in 2023 but averted when an agreement was reached and with Village and Courtside Centres in Mbombela, in the same year, where power was cut off due to non-payment for municipal services)

Zambezi/Tshwane China Shopping Mall

Waterfall Residential Estate

We’ve known for a good while about the illegal occupation situation and have also been informed that Nova is (or has been) in discussion with Rustenburg Local Municipality on the matter. Of course, Nova have not disclosed anything about this. We have no information on the current state of play and we wonder if Nova will ever be able to recover possession (do they actually carde?) or, is this property now a lost cause and will have to be written off? AFS ’23 book value was 50.8 million

If there’s any spark of good news in all of this, it is that in AFS ’23, the debenture liabilities for these properties is present and they show as:

- Liberty/Amogela: 21.6 million (but see above re reduced value in the ’24 AFS)

- Zambezi: 503.4 million

- Waterfall: 47.2 million

However, note our comment above regarding lack of confidence in the executive to ever deliver repayment

Those liabilities must remain whatever the fate of the underlying properties and they are so listed in the ’24 AFS. In fact, in the Director’s Report in AFS ’24 it was stated that:

The corresponding debenture liabilities remain payable in accordance with the provisions of the Schemes of Arrangement.

The downside in all of this is the wider implications that events/situations like the above have. They just weaken the company which, for many years now has been subject to ongoing opinion that it just doesn’t have the capability to repay, that it is technically insolvent, and that there is no intention to repay further anyway (an opinion stated by the CIPC in September ’22 – as quoted by Moneyweb). This, despite all of the excuses and assurances issued down the years and which for most of the duration of the company and its assets, have only been received with a great deal of skepticism if not outright rejection

Is all of the above accurate? To the best of our knowledge, yes. But in the event that it isn’t, we would welcome a communication from the Nova board pointing out where we may be incorrect but more importantly, filling in the gaps detailed above. Plus, of course, it would be an actual communication, a very rare event during the past number of year.